A credit Report dispute letter is a formal document used to challenge inaccuracies or errors in your credit report. By effectively disputing incorrect information, you can protect your financial reputation and improve your credit score. This guide will provide you with the essential elements and design principles for creating a professional and persuasive credit report dispute letter template.

Essential Components

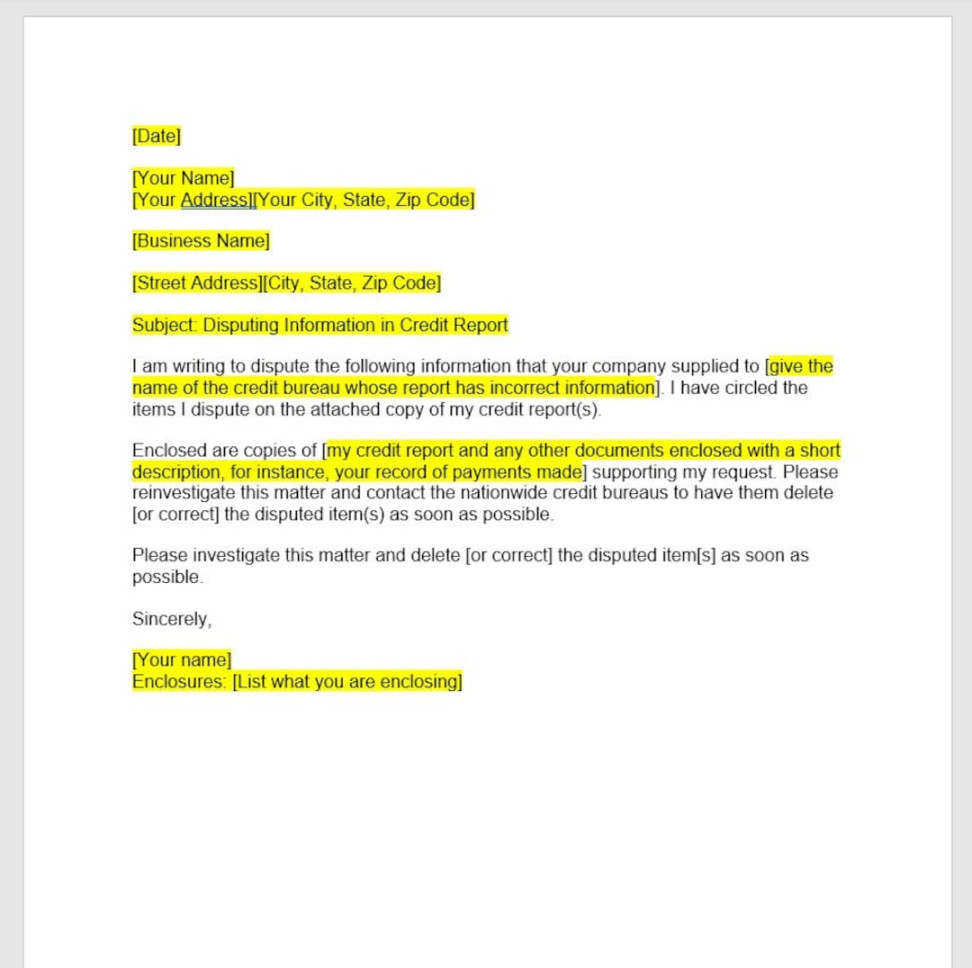

1. Your Contact Information: Begin the letter by clearly stating your full name, address, phone number, and email address. This information will enable the credit reporting agency to respond directly to your dispute.

2. Credit Reporting Agency Information: Identify the credit reporting agency you are addressing (e.g., Equifax, Experian, TransUnion) and include their contact information. This ensures that your letter is directed to the appropriate department.

3. Reference Number: If you have a reference number or account number associated with the disputed information, include it in the letter. This will help the credit reporting agency locate the specific account or report in question.

4. Date of Dispute: Clearly indicate the date you are submitting the dispute letter. This will establish a timeline for the credit reporting agency to investigate and respond.

5. Disputed Information: Provide a detailed description of the incorrect information on your credit report. Be as specific as possible, including the creditor’s name, account number, and the nature of the error (e.g., incorrect balance, late payment, account status).

6. Supporting Documentation: If you have any supporting documents that can substantiate your claim, attach copies to the letter. This could include canceled checks, payment receipts, or correspondence with the creditor.

7. Request for Correction: Clearly state your request for the credit reporting agency to investigate and correct the disputed information. Specify the desired outcome, such as the removal of the incorrect item or the update of the account status.

8. Closure: End the letter with a polite and professional closing, such as “Sincerely” or “Respectfully.”

Design Elements for Professionalism and Trust

1. Layout and Formatting: Choose a clean and easy-to-read font, such as Arial or Times New Roman. Use a standard font size (10-12 points) and maintain consistent margins throughout the letter.

2. Letterhead: If possible, create a letterhead with your name, address, and contact information at the top of the page. This will add a professional touch and make the letter more memorable.

3. Salutation: Address the letter to a specific individual at the credit reporting agency, if possible. This demonstrates that you have done your research and shows respect for the recipient.

4. Clarity and Conciseness: Write in a clear and concise manner, avoiding unnecessary jargon or technical terms. Use simple language that is easy to understand.

5. Proofreading and Editing: Carefully proofread the letter for any errors in grammar, spelling, or punctuation. This will ensure that your letter is professional and error-free.

Additional Considerations

Multiple Disputes: If you have multiple errors on your credit report, consider submitting separate dispute letters for each issue to avoid confusion.

By following these guidelines and incorporating the recommended design elements, you can create a professional and persuasive credit report dispute letter that increases your chances of successfully resolving the issue.