What is a Cash Position Report Template?

A Cash Position Report Template is a structured document that provides a clear and concise overview of a company’s cash inflows and outflows over a specific period. It serves as a vital tool for financial management, enabling businesses to assess their liquidity, identify potential cash shortages, and make informed decisions regarding cash allocation and investment.

Key Components of a Cash Position Report Template

A well-designed Cash Position Report Template typically includes the following essential components:

1. Header

Company Name: Clearly state the name of the company for which the report is prepared.

2. Executive Summary

Overall Cash Position: Provide a brief summary of the company’s overall cash position, highlighting any significant changes or trends.

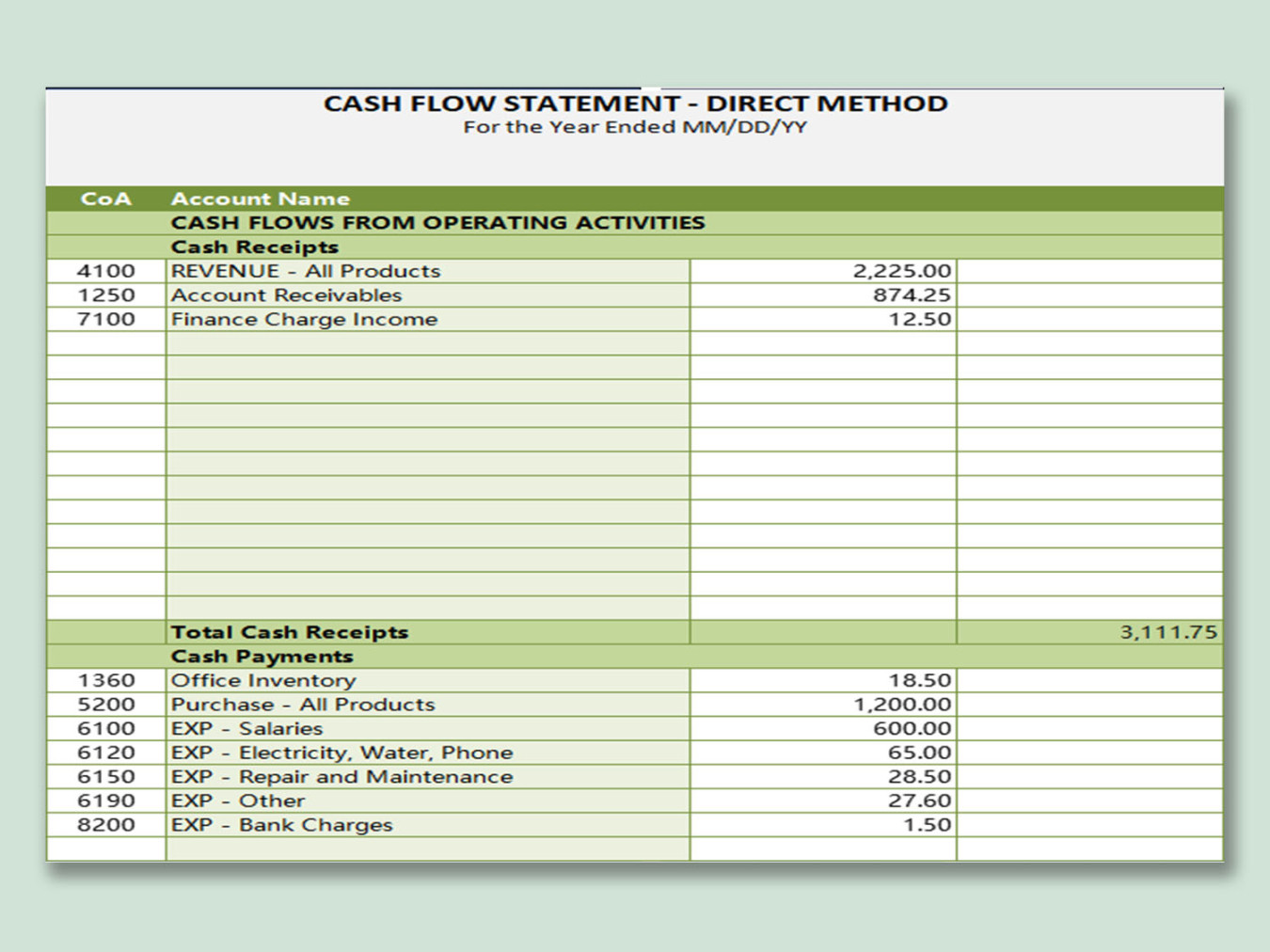

3. Cash Flow Statement

Cash Inflows: List all sources of cash inflows, such as sales revenue, interest income, and loan repayments.

4. Cash Balance Analysis

Beginning Cash Balance: State the opening cash balance at the beginning of the report period.

5. Cash Forecasts

Future Projections: Present projected cash inflows and outflows for upcoming periods (e.g., next month, next quarter).

6. Liquidity Ratios

Current Ratio: Calculate the current ratio to assess the company’s ability to meet short-term obligations.

7. Comments and Analysis

Significant Fluctuations: Explain any significant changes in cash inflows or outflows.

Design Considerations for Professionalism and Trust

To convey professionalism and trust, consider the following design elements:

Layout and Formatting

Consistent Formatting: Use a consistent font, font size, and spacing throughout the report.

Tables and Charts

Clear and Concise: Use tables and charts to present data in a visually appealing and easy-to-understand manner.

Branding and Consistency

Company Branding: Incorporate the company’s branding elements, such as logo and color scheme, into the report design.

Professional Appearance

High-Quality Printing: Print the report on high-quality paper to enhance its professional appearance.

By adhering to these guidelines, you can create a Cash Position Report Template that effectively communicates the company’s financial health, fosters trust with stakeholders, and supports informed decision-making.