A promissory note is a legal document that serves as a written promise to repay a debt. It outlines the terms and conditions of the loan, including the principal amount, interest rate, repayment schedule, and any collateral. A well-crafted promissory note template can help ensure that both the lender and borrower are protected and that the transaction is clear and legally binding.

Essential Elements of a Promissory Note

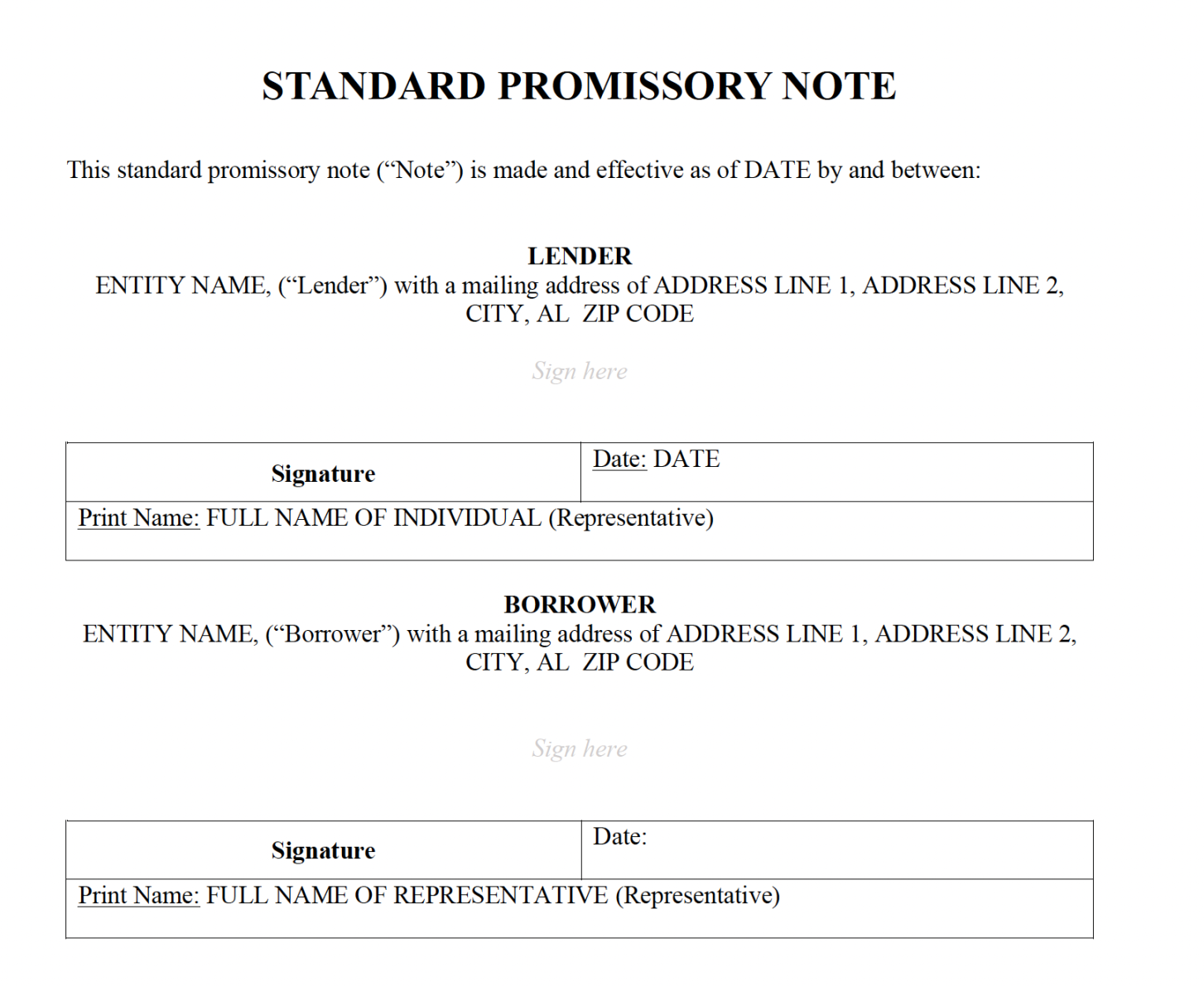

1. Parties Involved: Clearly identify the lender and borrower by their full legal names and addresses.

2. Principal Amount: Specify the exact amount of money being borrowed.

3. Interest Rate: Indicate the annual percentage rate (APR) at which interest will accrue on the loan.

4. Repayment Schedule: Outline the frequency and due dates of payments, whether they are fixed or variable.

5. Maturity Date: State the final date by which the loan must be fully repaid, including any interest.

6. Default Provisions: Specify the consequences of failing to make timely payments, such as late fees, acceleration of the loan balance, or legal action.

7. Prepayment Clause: Determine whether the borrower can repay the loan in full before the maturity date and, if so, whether there are any prepayment penalties.

8. Governing Law: Indicate the jurisdiction under which the promissory note will be governed.

9. Notices: Specify the address to which notices and correspondence should be sent.

10. Signatures: Ensure that both the lender and borrower sign the promissory note in the presence of a witness.

Design Elements for Professionalism and Trust

1. Clarity and Conciseness: Use clear and concise language that is easy to understand. Avoid legal jargon that may confuse the parties involved.

2. Professional Layout: Choose a clean and professional layout that is visually appealing and easy to read. Use a font that is easy on the eyes, such as Arial or Times New Roman.

3. Consistent Formatting: Maintain consistent formatting throughout the document, including font size, line spacing, and margins.

4. Headings and Subheadings: Use headings and subheadings to organize the information and make it easier to navigate.

5. White Space: Incorporate white space to improve readability and make the document less cluttered.

6. Professional Stationery: If possible, print the promissory note on high-quality stationery with your company logo or letterhead.

7. Legal Disclaimer: While not strictly required, a legal disclaimer can provide additional protection for the lender. It should state that the promissory note is a legally binding contract and that any disputes will be resolved in accordance with the governing law.

Additional Considerations

Collateral: If the loan is secured by collateral, clearly describe the property being used as collateral and the terms of the security agreement.

By following these guidelines, you can create a professional and legally sound promissory note template that will protect your interests and ensure a smooth transaction.