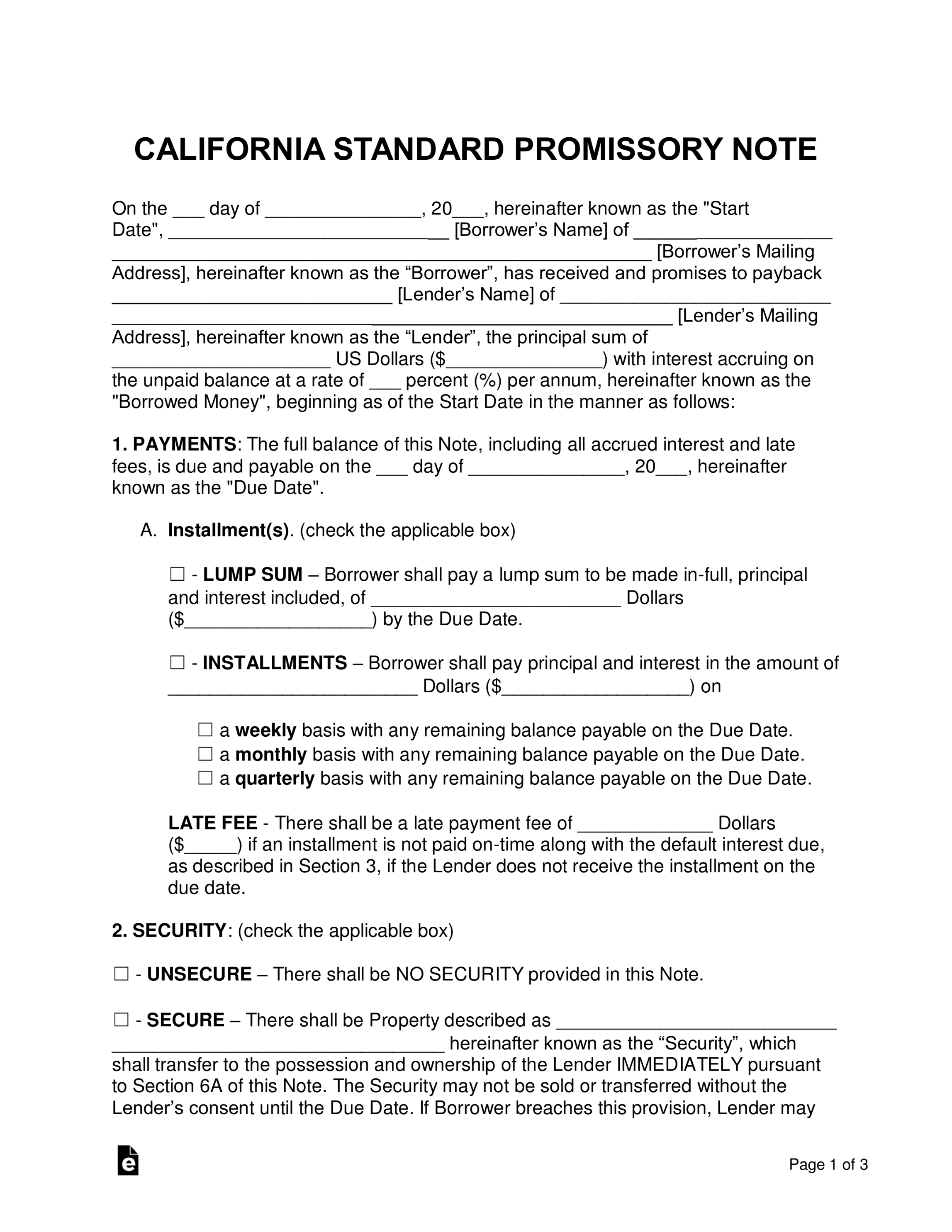

A California Promissory Note Template is a legally binding document that outlines the terms of a loan agreement between a lender and a borrower. It serves as a formal contract that specifies the amount of the loan, the interest rate, the repayment schedule, and other essential details. When creating a California Promissory Note Template, it is crucial to adhere to specific legal requirements and design elements that convey professionalism and instill trust in both parties involved.

Essential Components of a California Promissory Note Template

1. Parties Involved: Clearly identify the lender and the borrower. Include their full legal names and addresses.

2. Loan Amount: Specify the exact amount of the loan in both numerical and written form.

3. Interest Rate: Indicate the annual interest rate that will be charged on the loan. This can be a fixed rate or a variable rate.

4. Repayment Schedule: Outline the terms of repayment, including the frequency of payments (e.g., monthly, quarterly, annually) and the due date for each payment.

5. Prepayment Clause: Specify whether the borrower has the right to prepay the loan before the maturity date and, if so, whether there are any prepayment penalties.

6. Default Clause: Define what constitutes a default on the loan and outline the consequences of default, such as late fees, acceleration of the loan balance, or legal action.

7. Governing Law: Specify the state law that will govern the terms of the loan agreement. In this case, it should be California law.

8. Signatures: Ensure that both the lender and the borrower sign the promissory note to indicate their agreement to the terms.

Design Elements for a Professional California Promissory Note Template

1. Clarity and Conciseness: Use clear and concise language throughout the template to avoid confusion and misunderstandings. Avoid legal jargon that may be unfamiliar to the parties involved.

2. Professional Layout: Employ a professional and visually appealing layout that is easy to read and understand. Use a consistent font and font size throughout the document.

3. White Space: Incorporate ample white space to improve readability and create a clean and organized appearance.

4. Headings and Subheadings: Use headings and subheadings to divide the template into sections and make it easier to navigate.

5. Numbering and Bullets: Use numbering and bullets to list items and create a structured format.

6. Alignment: Ensure that the text is aligned consistently throughout the template, either left-aligned, right-aligned, or centered.

7. Branding: If applicable, consider including your company’s logo or branding elements to enhance professionalism and recognition.

Additional Considerations

1. Customization: Tailor the template to meet the specific needs of the loan agreement. Consider including additional clauses or provisions as necessary.

2. Legal Review: Consult with an attorney to ensure that the template complies with all applicable California laws and regulations.

3. Electronic Signatures: If desired, consider using electronic signatures to expedite the process and reduce the need for physical copies.

By carefully considering these essential components and design elements, you can create a professional and legally sound California Promissory Note Template that effectively outlines the terms of the loan agreement and protects the interests of both the lender and the borrower.