A commercial mortgage broker fee agreement template is a legal document that outlines the terms and conditions between a commercial mortgage broker and a client. It serves as a contract that defines the scope of services, fees, and responsibilities of both parties. This guide will delve into the essential components of a professional commercial mortgage broker fee agreement template and provide insights on how to effectively design it to convey professionalism and trust.

Key Components of a Commercial Mortgage Broker Fee Agreement Template

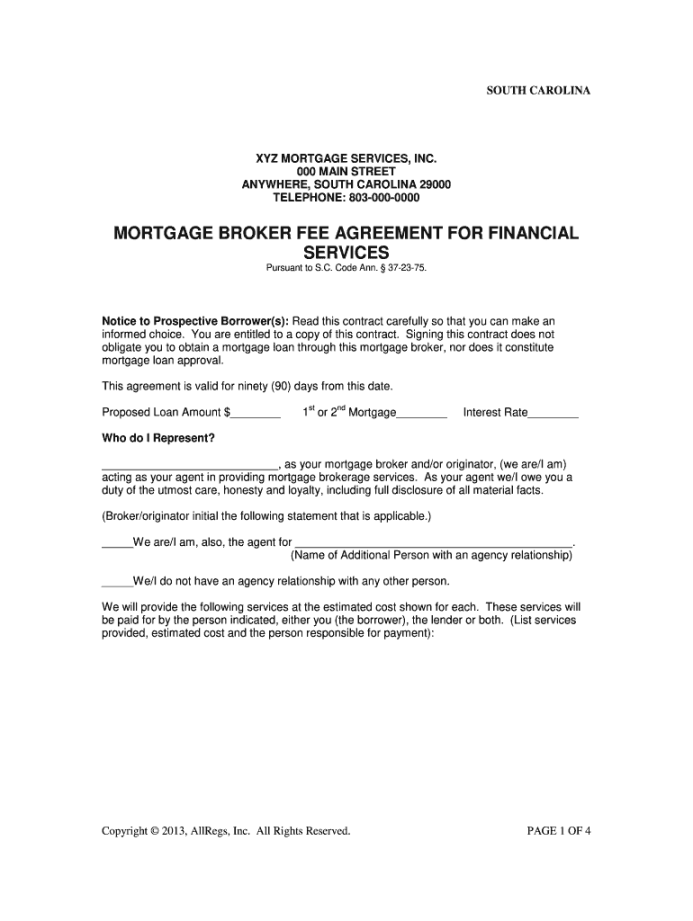

1. Parties Involved: Clearly identify the parties involved in the agreement. This includes the name and contact information of the commercial mortgage broker and the client.

2. Scope of Services: Define the specific services that the broker will provide. This may include identifying suitable lenders, negotiating terms, and assisting with the loan application process. Be as detailed as possible to avoid misunderstandings.

3. Fees and Compensation: Outline the compensation structure for the broker’s services. This may involve a flat fee, a percentage of the loan amount, or a combination of both. Specify when the fees are due and if there are any additional charges or expenses.

4. Reimbursement of Expenses: Indicate if the client is responsible for reimbursing the broker for any out-of-pocket expenses incurred during the loan process.

5. Confidentiality: Address the confidentiality obligations of both parties. This ensures that sensitive information shared during the loan process remains protected.

6. Term and Termination: Specify the duration of the agreement and the conditions under which either party can terminate it. Consider including clauses for early termination and default.

7. Indemnification: Outline the indemnification obligations of each party. This protects both parties from potential liabilities arising from the agreement.

8. Governing Law and Dispute Resolution: Specify the governing law that will apply to the agreement and the dispute resolution mechanism, such as mediation or arbitration.

9. Entire Agreement: Include a clause stating that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

10. Signatures: Ensure that both parties sign the agreement to make it legally binding.

Design Elements for a Professional Commercial Mortgage Broker Fee Agreement Template

1. Clear and Concise Language: Use plain language that is easy to understand for both parties. Avoid legal jargon that may confuse clients.

2. Consistent Formatting: Maintain consistent formatting throughout the document, using headings, subheadings, and bullet points to improve readability.

3. Professional Layout: Choose a professional font and font size that is easy to read. Use appropriate margins and spacing to create a clean and organized appearance.

4. Branding Elements: If applicable, incorporate your branding elements, such as your logo and company colors, to enhance the professionalism of the document.

5. Organization: Arrange the components of the agreement in a logical order, starting with the introductory sections and progressing to the more detailed terms and conditions.

6. Accessibility: Ensure that the document is accessible to individuals with disabilities by following accessibility guidelines.

7. Legal Review: Have the agreement reviewed by an attorney to ensure that it complies with applicable laws and regulations.

By carefully considering these key components and design elements, you can create a professional commercial mortgage broker fee agreement template that effectively protects your interests and establishes a strong foundation for your business relationships.