A convertible loan agreement is a legal document that outlines the terms and conditions of a loan that can be converted into equity, typically common stock, under certain circumstances. This type of financing is often used by startups and early-stage companies that need capital but may not be ready for a traditional equity round.

Key Components of a Convertible Loan Agreement

A well-structured convertible loan agreement should include the following essential components:

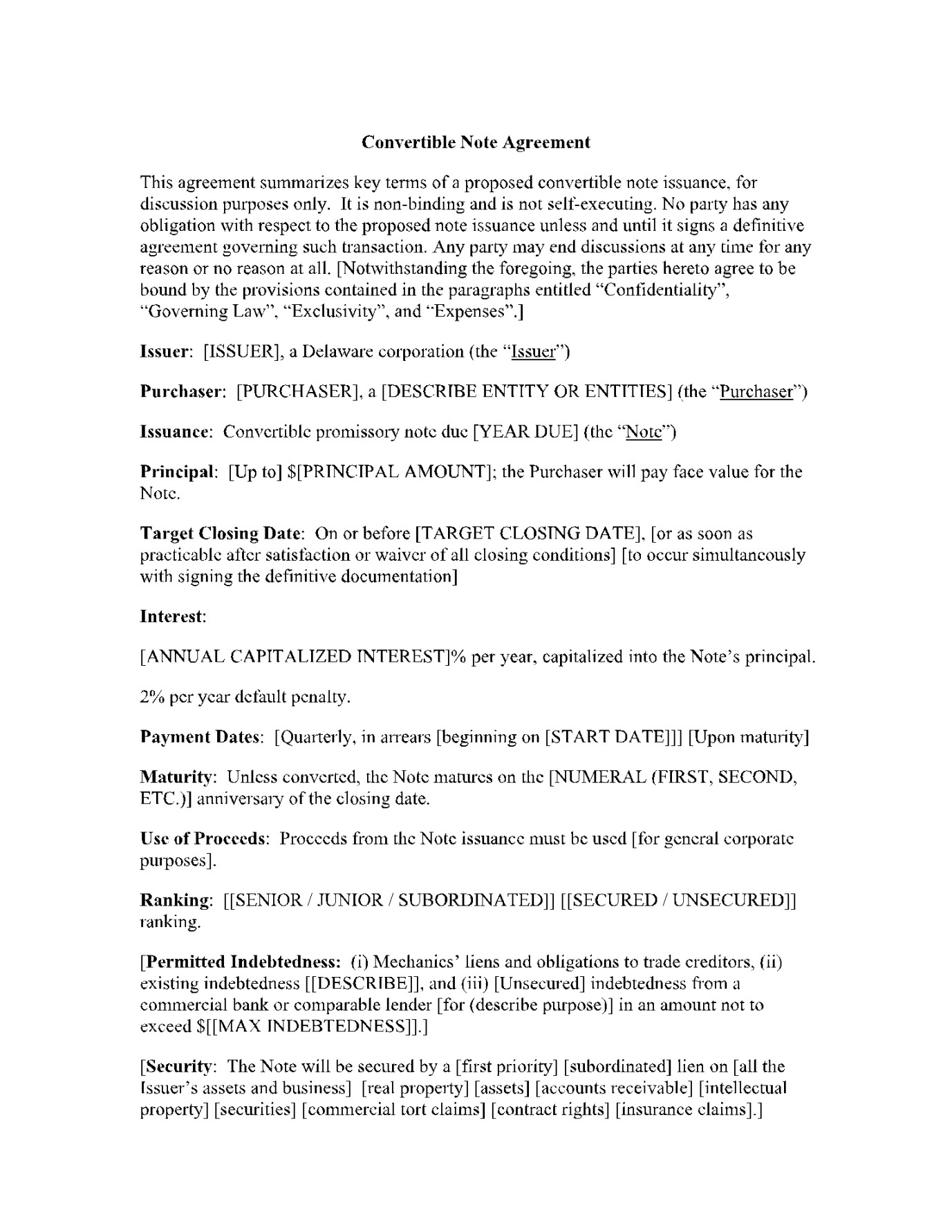

Loan Amount and Terms

Principal Amount: Clearly state the total amount of the loan.

Conversion Features

Conversion Price: Define the price per share at which the loan can be converted into equity. This is often determined by a formula or a valuation cap.

Security and Collateral

Security Interest: If applicable, outline any security interest granted by the borrower to the lender, such as a lien on assets.

Default and Remedies

Default Events: Define the events that constitute a default, such as failure to make payments or breach of covenants.

Representations and Warranties

Borrower Representations: Include statements made by the borrower regarding its financial condition, business operations, and compliance with laws.

Covenants

Affirmative Covenants: Outline the actions that the borrower must take, such as maintaining insurance coverage, providing financial information, and complying with laws.

Miscellaneous Provisions

Governing Law: Specify the jurisdiction whose laws will govern the agreement.

Design Considerations for a Professional Convertible Loan Agreement

A professionally designed convertible loan agreement should be visually appealing, easy to read, and convey a sense of trust. Here are some design elements to consider:

Clear and Concise Language: Use plain language that is easy to understand, avoiding legal jargon whenever possible.

Conclusion

A well-crafted convertible loan agreement is essential for protecting the interests of both the borrower and the lender. By carefully considering the key components and design elements outlined in this guide, you can create a professional and effective document that serves as a solid foundation for your financing arrangement.