Design Elements for Professionalism and Trust

A well-designed credit Card payment spreadsheet template can enhance the credibility and efficiency of your business transactions. By incorporating specific design elements, you can create a template that is both visually appealing and functionally effective.

1. Clean and Uncluttered Layout

A clean and uncluttered layout is essential for a professional spreadsheet template. Avoid excessive clutter by using ample white space, consistent formatting, and clear labeling. This will make the template easier to read and navigate, improving user experience.

2. Consistent Branding

Ensure that your template aligns with your brand identity. Use consistent fonts, colors, and logos throughout the template to maintain a cohesive appearance. This will reinforce your brand recognition and create a professional impression.

3. Clear and Concise Labels

Use clear and concise labels for all fields in your template. Avoid abbreviations or jargon that may be unfamiliar to users. This will ensure that the template is easy to understand and use, even for those who are not spreadsheet experts.

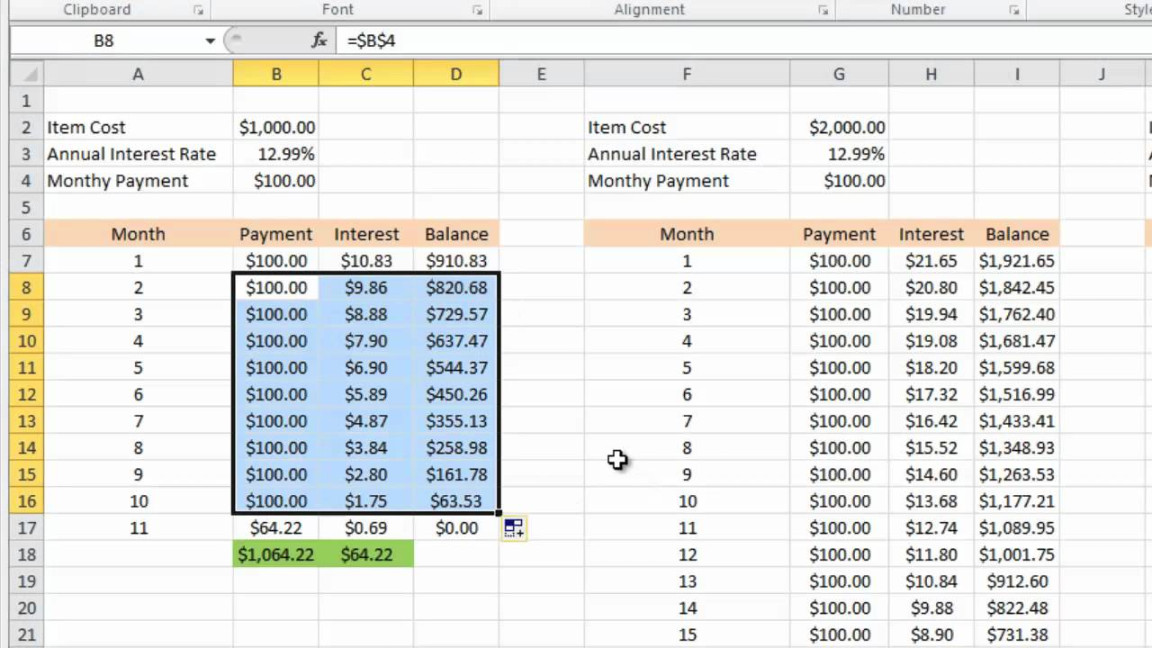

4. Logical Data Organization

Organize your data in a logical and intuitive manner. Group related information together and use headings and subheadings to improve readability. This will make it easier for users to find the information they need and complete the payment process efficiently.

5. Error Checking and Validation

Implement error checking and validation features to prevent data entry errors. This can include features such as required fields, data type validation, and range checking. By preventing errors, you can reduce the risk of payment processing issues and improve overall accuracy.

6. Secure Data Handling

Protect sensitive customer information by implementing appropriate security measures. This may include encrypting data, limiting access to authorized personnel, and following industry best practices for data security. By safeguarding customer data, you can build trust and protect your business from potential liabilities.

7. User-Friendly Interface

Design your template with the user in mind. Use a simple and intuitive interface that is easy to navigate. Avoid complex formulas or functions that may confuse users. By providing a user-friendly experience, you can increase template adoption and reduce support requirements.

8. Mobile Compatibility

Consider the growing trend of mobile devices. Design your template to be mobile-friendly, ensuring that it can be viewed and used effectively on smaller screens. This will make it more accessible to a wider range of users and improve the overall user experience.

9. Customization Options

Provide customization options to allow users to tailor the template to their specific needs. This may include options for adding or removing fields, changing the layout, or customizing the appearance. By offering customization options, you can increase template flexibility and meet the diverse requirements of your users.

10. Accessibility Considerations

Ensure that your template is accessible to users with disabilities. This may involve using appropriate color contrasts, providing alternative text for images, and following accessibility guidelines such as WCAG. By making your template accessible, you can improve inclusivity and comply with legal requirements.

By incorporating these design elements into your credit card payment spreadsheet template, you can create a professional and trustworthy tool that enhances the efficiency and credibility of your business transactions.