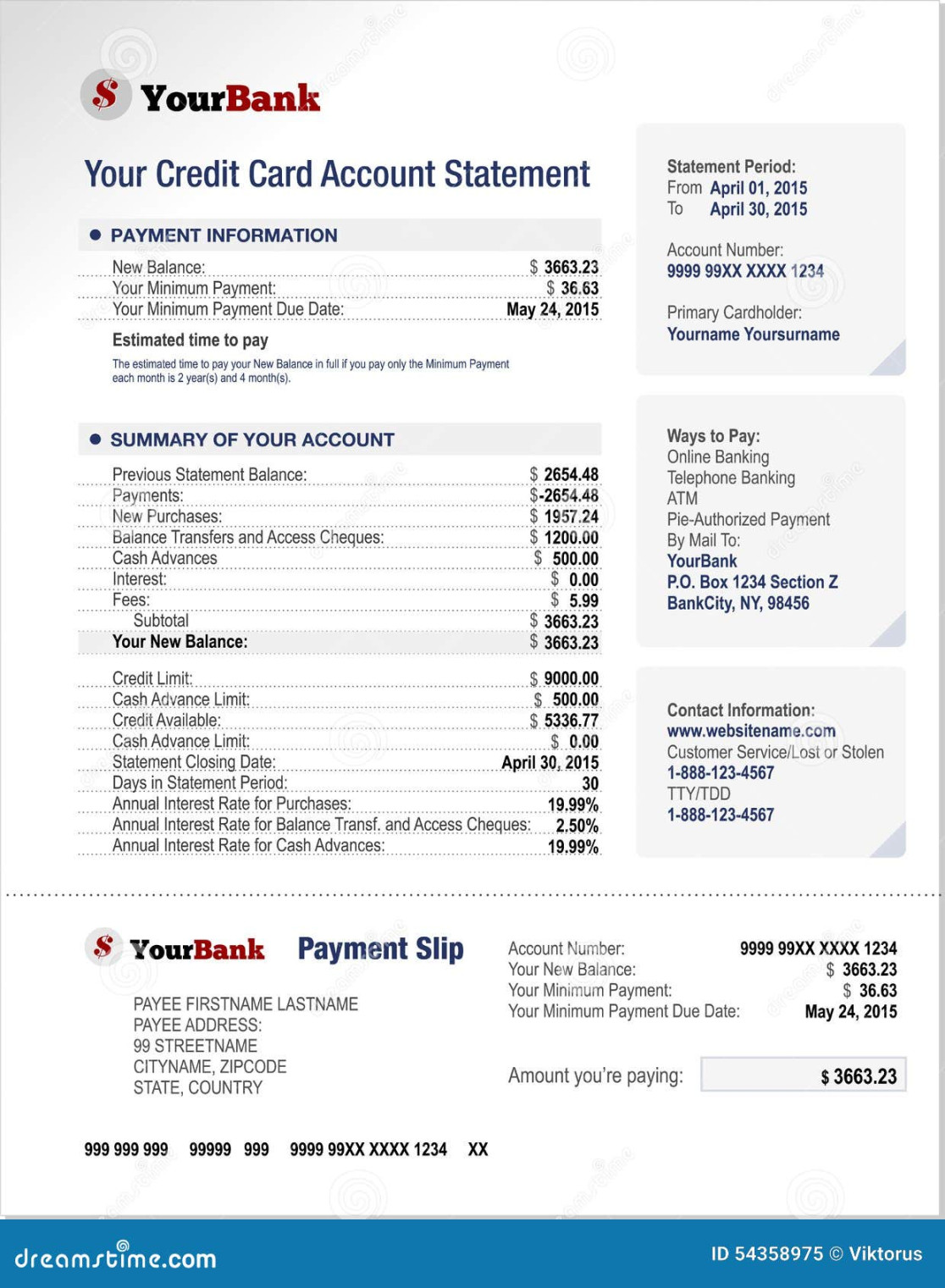

A credit Card statement template serves as a crucial communication tool between financial institutions and their customers. It provides a detailed overview of account activity, including transactions, balances, and due dates. A well-designed template not only conveys essential information but also reinforces the institution’s professionalism and trustworthiness.

Key Design Elements for a Professional Credit Card Statement Template

1. Clear and Concise Layout

Whitespace: Use ample whitespace to enhance readability and create a visually appealing layout.

2. Branding Consistency

Logo Placement: Position the financial institution’s logo prominently at the top or bottom of the template.

3. Essential Information Sections

Account Information: Clearly display the customer’s name, account number, and statement period.

4. Visual Cues

Headings and Subheadings: Use clear and concise headings and subheadings to guide the reader through the template.

5. Security Measures

Confidentiality Notice: Clearly state that the institution is committed to protecting customer information.

6. Accessibility

Large Font Sizes: Ensure that the font size is large enough to be easily read by individuals with visual impairments.

7. Environmental Considerations

Paperless Options: Provide options for electronic delivery to reduce paper consumption.

8. Legal Compliance

Regulatory Requirements: Ensure that the template complies with all relevant legal and regulatory requirements.

By incorporating these design elements, financial institutions can create credit card statement templates that are both informative and visually appealing. A well-designed template can enhance customer satisfaction, build trust, and reinforce the institution’s professional image.