A debt negotiation letter is a formal document that is sent to creditors to request a reduction or modification of a debt. It is a crucial tool for individuals or businesses that are struggling to make their payments. A well-crafted debt negotiation letter can help to improve your financial situation and avoid bankruptcy.

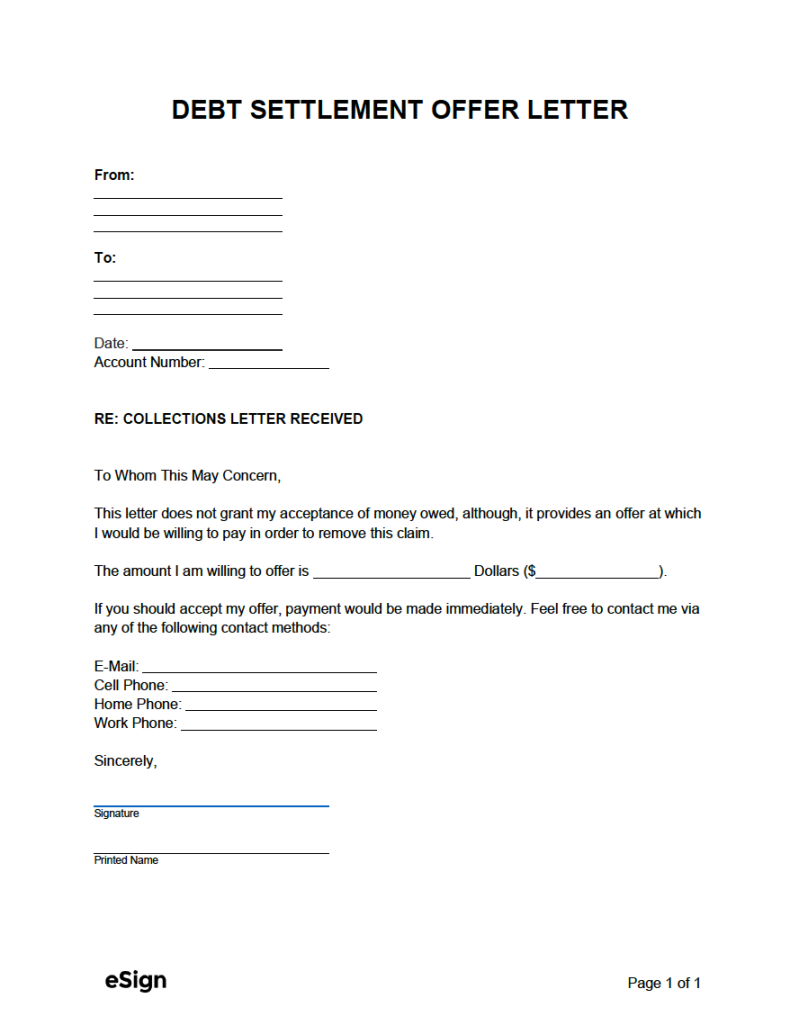

Essential Elements of a Debt Negotiation Letter

1. Your Contact Information

2. Creditor’s Contact Information

3. Date

4. Salutation

5. Body of the Letter

6. Closing

Design Elements for a Professional Debt Negotiation Letter

Use a professional font. Arial, Times New Roman, or Calibri are all good choices.

Example Debt Negotiation Letter

Dear [Creditor’s Name],

I am writing to request a negotiation of my outstanding debt with [Creditor’s Name]. My account number is [Account Number].

Due to [Reason for financial hardship], I have been unable to make my payments on time. I believe that a settlement agreement would be beneficial to both of us.

I am proposing a settlement of [Settlement amount]. I am able to make a one-time payment of [Amount] within [Timeframe].

I have attached copies of my [Supporting documentation].

I am open to discussing other options. Please contact me at your earliest convenience to discuss this matter further.

Sincerely,

[Your Name]

Additional Tips

Be polite and respectful. Even if you are in a difficult financial situation, it is important to be polite and respectful to the creditor.

By following these guidelines, you can create a professional debt negotiation letter that will increase your chances of reaching a favorable agreement with your creditors.