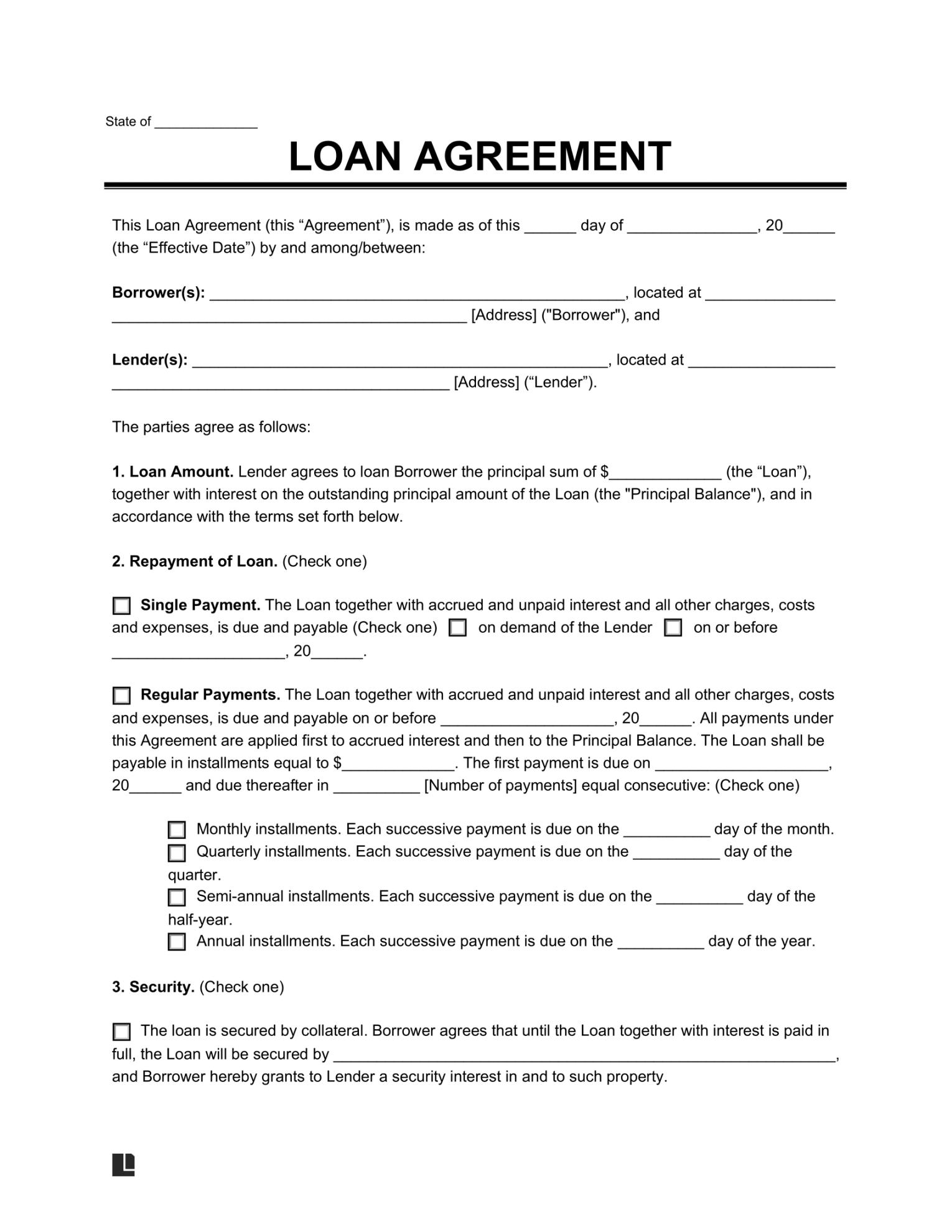

What is a Private Loan Agreement Template?

A private loan agreement template is a pre-formatted document that outlines the terms and conditions of a loan between two parties. It serves as a legal contract that protects the interests of both the lender and the borrower. By using a well-crafted template, you can ensure that your loan transaction is clear, fair, and legally binding.

Essential Elements of a Private Loan Agreement Template

A comprehensive private loan agreement template should include the following key elements:

1. Parties Involved

Lender: The individual or entity providing the loan.

2. Loan Amount and Terms

Principal Amount: The total amount of the loan.

3. Collateral (Optional)

Description of Collateral: If applicable, specify the assets that will secure the loan.

4. Default Provisions

Events of Default: Define circumstances that constitute a breach of the agreement.

5. Governing Law and Jurisdiction

Governing Law: Indicate the applicable laws that will govern the agreement.

6. Dispute Resolution

7. Entire Agreement

Designing a Professional Private Loan Agreement Template

To create a template that conveys professionalism and trust, consider the following design elements:

1. Clear and Concise Language

Use plain language that is easy to understand for both parties.

2. Consistent Formatting

Use consistent fonts, font sizes, and spacing throughout the template.

3. Professional Layout

Choose a clean and modern layout that is visually appealing.

4. Branding (Optional)

If applicable, incorporate your company’s branding elements into the template.

Additional Tips

Consult with an Attorney: While a template can provide a solid foundation, it’s advisable to consult with an attorney to ensure that the agreement complies with applicable laws and protects your interests.

By following these guidelines, you can create a professional and effective private loan agreement template that safeguards your financial interests and fosters trust between the lender and borrower.