A promise to pay agreement is a legal document that outlines the terms and conditions under which one party agrees to pay another party a specific amount of money. This type of agreement is often used in various situations, such as:

Debt Settlement: When a debtor agrees to pay a reduced amount to settle a larger debt.

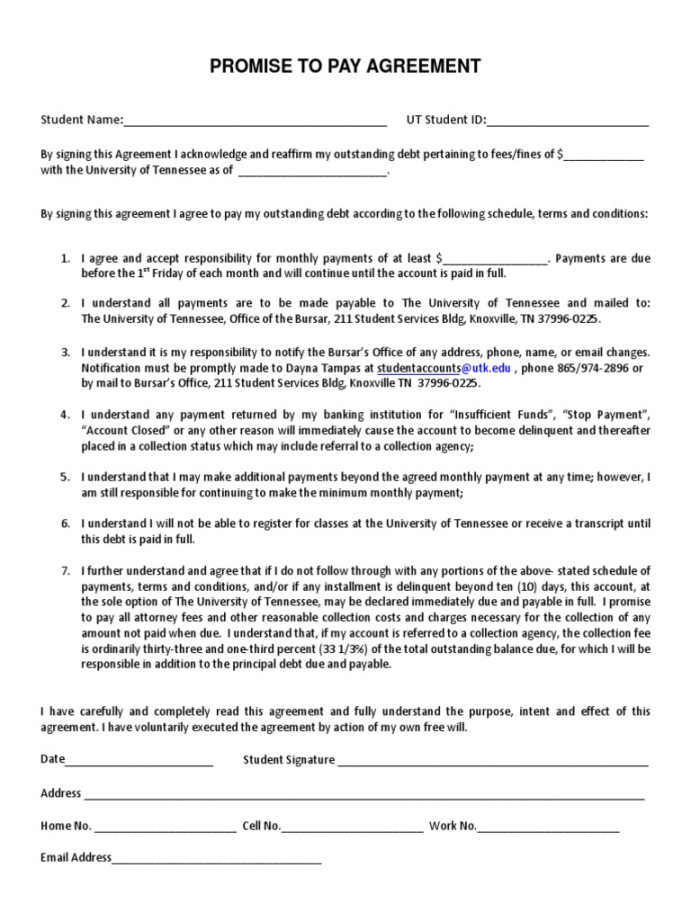

Essential Elements of a Promise to Pay Agreement

A well-crafted promise to pay agreement should include the following essential elements:

1. Identification of Parties

Clearly state the names and addresses of all parties involved in the agreement. This information should be presented in a formal and professional manner.

2. Recital of Consideration

Explain the consideration that each party is providing. This could be a promise to pay money, provide goods or services, or perform other actions.

3. Promise to Pay

Explicitly state the amount of money that the debtor agrees to pay and the due date(s). If there are any interest charges or penalties for late payment, these should also be clearly outlined.

4. Payment Terms

Specify the method of payment (e.g., check, wire transfer, credit Card) and the address where payments should be sent.

5. Default Provisions

Outline the consequences of the debtor’s failure to make timely payments. This may include late fees, acceleration of the debt, or legal action.

6. Governing Law and Jurisdiction

Indicate the state or country whose laws will govern the agreement. Also, specify the jurisdiction where any disputes arising from the agreement will be resolved.

7. Entire Agreement Clause

Include a clause stating that the agreement constitutes the entire understanding between the parties and supersedes any prior or contemporaneous communications.

8. Severability Clause

If any provision of the agreement is found to be invalid or unenforceable, the remaining provisions should remain in full force and effect.

9. Signature Block

Provide a space for each party to sign the agreement. The signature block should include the date of signing and the printed name of each party.

Design Elements for a Professional Promise to Pay Agreement

To convey professionalism and trust, consider the following design elements:

Use a Formal Font: Choose a font that is easy to read and conveys a sense of authority, such as Times New Roman, Arial, or Garamond.

Conclusion

A well-crafted promise to pay agreement is a valuable tool for resolving debts and ensuring that obligations are met. By following the guidelines outlined in this guide, you can create a professional and legally sound document that protects your interests and establishes clear expectations between the parties involved.