A Promissory Note is a legal document that outlines a debt and the terms for its repayment. It is a formal agreement between a lender and a borrower, where the borrower promises to pay back a specific amount of money to the lender within a specified time frame.

Key Elements of a Promissory Note

A well-structured Promissory Note should include the following essential elements:

1. Identification of Parties

2. Promissory Language

3. Principal Amount

4. Interest Rate

5. Repayment Schedule

6. Maturity Date

7. Default Provisions

8. Governing Law

9. Notices

10. Execution

Design Elements for Professionalism and Trust

To create a Promissory Note that conveys professionalism and trustworthiness, consider the following design elements:

Font: Choose a clean, legible font that is easy to read. Avoid overly decorative fonts.

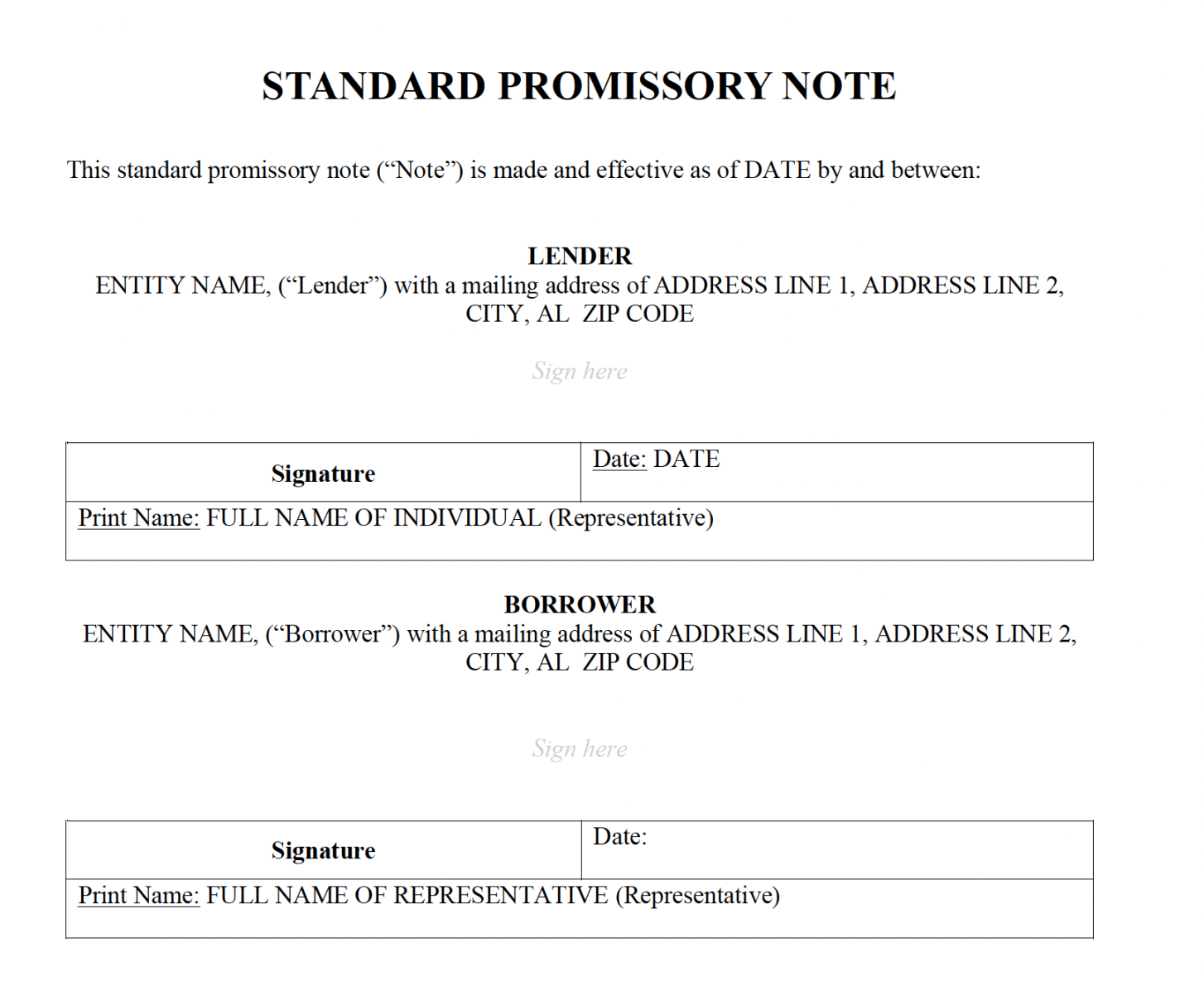

Example Promissory Note Template

[Your Company Name]

Promissory Note

This Promissory Note is made and entered into on [Date] by and between [Lender’s Name], hereinafter referred to as the “Lender,” and [Borrower’s Name], hereinafter referred to as the “Borrower.”

1. Principal Amount: The Borrower promises to pay the Lender the sum of [Principal Amount] Dollars ($[Principal Amount]).

2. Interest Rate: The Borrower shall pay interest on the unpaid principal balance of this Note at the rate of [Interest Rate]% per annum.

3. Repayment Schedule: The Borrower shall repay the principal and accrued interest in [Number] equal installments of [Amount] Dollars each, due and payable on the [Day] day of each month, beginning on [Date].

4. Default: If the Borrower fails to make any payment due under this Note, the Lender may, at its option, accelerate the balance of the Note and demand immediate payment.

5. Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of [State].

6. Notices: All notices required or permitted under this Note shall be given in writing and shall be deemed to have been given when delivered by hand or by certified mail, return receipt requested, to the address of the party to whom such notice is addressed.

IN WITNESS WHEREOF, the parties have executed this Promissory Note as of the date first written above.

[Lender’s Signature]

[Lender’s Name]

[Borrower’s Signature]

[Borrower’s Name]

Customization and Legal Advice

Remember that this is a general template, and you may need to customize it to fit your specific circumstances. It is highly recommended to consult with an attorney to ensure that your Promissory Note complies with applicable laws and protects your interests.