A Promissory Note is a legal document that outlines a debt and the terms for repayment. It is a formal agreement between a lender and a borrower, where the borrower promises to pay back a specific sum of money to the lender within a specified timeframe.

Elements of a Promissory Note

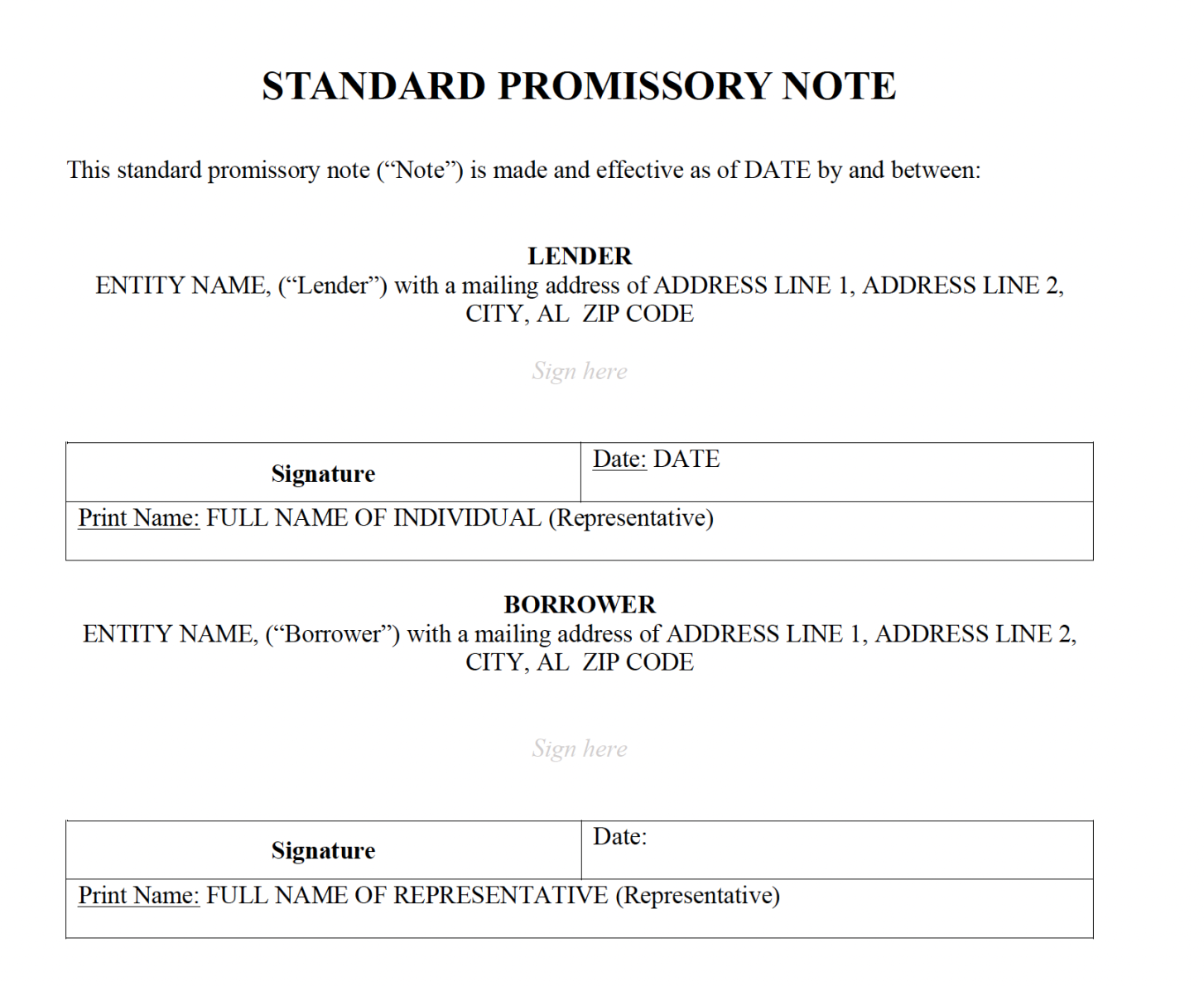

1. Parties Involved: Clearly identify the lender and the borrower. Include their full legal names and addresses.

2. Promise to Pay: State the borrower’s unequivocal promise to pay the lender a specific sum of money. This amount should be clearly stated in both numerals and words.

3. Repayment Terms: Specify the due date for the repayment. If applicable, outline any interest rates, payment schedules, or penalties for late payments.

4. Interest Rate: If interest applies, clearly state the annual percentage rate (APR). This should be expressed as a percentage.

5. Security: If the note is secured by collateral, describe the specific assets that will be used to guarantee the loan.

6. Governing Law: Indicate the jurisdiction that will govern the terms of the promissory note. This is important for resolving any disputes that may arise.

7. Signatures: Both the lender and the borrower must sign the note to make it legally binding.

Design Elements for a Professional Promissory Note

1. Clarity and Conciseness: Use clear and concise language throughout the document. Avoid legal jargon that may be difficult for non-lawyers to understand.

2. Professional Layout: Use a professional and easy-to-read font, such as Times New Roman or Arial. Maintain consistent margins and spacing throughout the document.

3. Heading and Subheadings: Use headings and subheadings to organize the information and make it easier to navigate.

4. Numbering and Bullets: Use numbering and bullets to list items, such as the repayment terms or the security provided.

5. White Space: Use ample white space to improve readability and create a visually appealing document.

6. Professional Letterhead: If applicable, include a professional letterhead with your company’s logo, contact information, and website address.

Example Promissory Note

Promissory Note

This Promissory Note is made and entered into on [Date] by and between [Lender’s Name], hereinafter referred to as the “Lender,” and [Borrower’s Name], hereinafter referred to as the “Borrower.”

1. Promise to Pay: The Borrower promises to pay to the Lender the sum of [Amount in Words] ($[Amount in Numerals]) on [Due Date].

2. Interest: The Borrower agrees to pay interest on the unpaid principal balance of this Note at the rate of [Interest Rate] per annum, compounded [Frequency].

3. Security: This Note is secured by [Description of Collateral].

4. Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of [State].

5. Signatures:

[Lender’s Signature] [Borrower’s Signature]

[Lender’s Printed Name] [Borrower’s Printed Name]

Note: This is a simplified example and may not include all necessary provisions, depending on the specific circumstances of the loan. It is recommended to consult with an attorney to ensure that the promissory note meets all legal requirements.