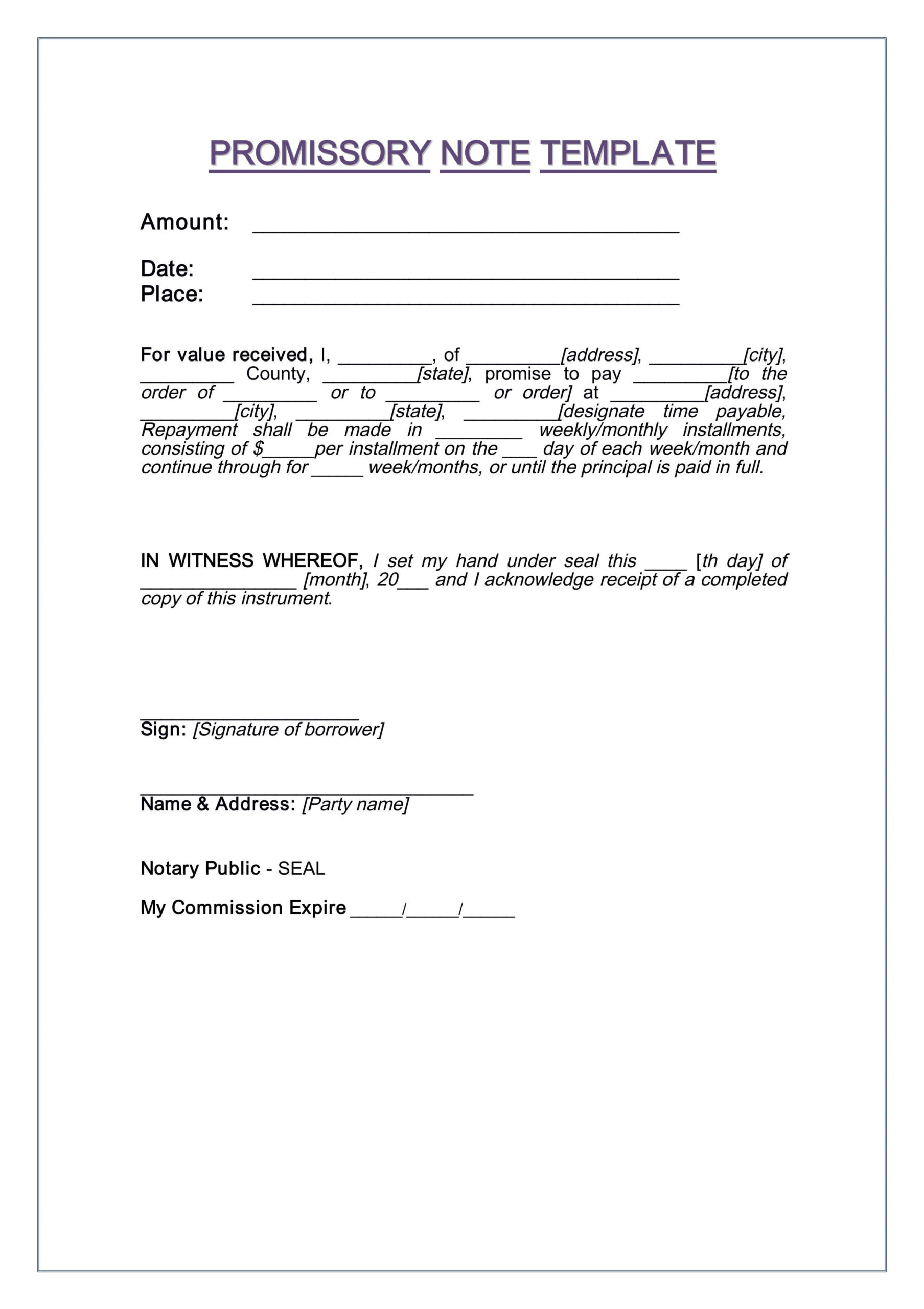

A Promissory Note Template is a formal document that outlines a debt agreement between two parties. It details the terms and conditions under which one party (the borrower) promises to repay a specific sum of money to the other party (the lender) within a specified timeframe.

Key Components of a Promissory Note Template

1. Parties Involved: Clearly identify the names and addresses of both the borrower and the lender.

2. Loan Amount: Specify the exact amount of money being borrowed.

3. Interest Rate: Indicate the interest rate that will be charged on the loan, and whether it is a fixed or variable rate.

4. Repayment Schedule: Outline the frequency and due dates of the loan payments.

5. Maturity Date: State the final date by which the loan must be fully repaid, including any interest.

6. Default Provisions: Specify the consequences of the borrower failing to make timely payments, such as late fees, acceleration of the loan balance, or legal action.

7. Governing Law: Indicate the jurisdiction under which the Promissory Note will be governed.

8. Signatures: Include a space for both the borrower and the lender to sign the document.

Design Elements for Professionalism and Trust

1. Layout and Formatting:

2. Language and Tone:

3. Clarity and Conciseness:

4. Legal Language:

5. Branding:

Example Promissory Note Template

PROMISE TO PAY

For value received, the undersigned promises to pay to [Lender’s Name], the sum of [Loan Amount] Dollars, together with interest thereon at the rate of [Interest Rate] per annum, payable [Frequency of Payments].

This note shall be due and payable on [Maturity Date]. In the event of default in the payment of any installment of principal or interest, the entire unpaid balance of this note shall become due and payable at the option of the Lender.

This note shall be governed by and construed in accordance with the laws of [Governing Law].

[Borrower’s Signature]

[Date]

[Lender’s Signature]

[Date]

By following these guidelines and incorporating the key design elements, you can create a professional and legally sound Promissory Note Template that effectively outlines the terms of a loan agreement.