Purpose of a Debt Validation Letter

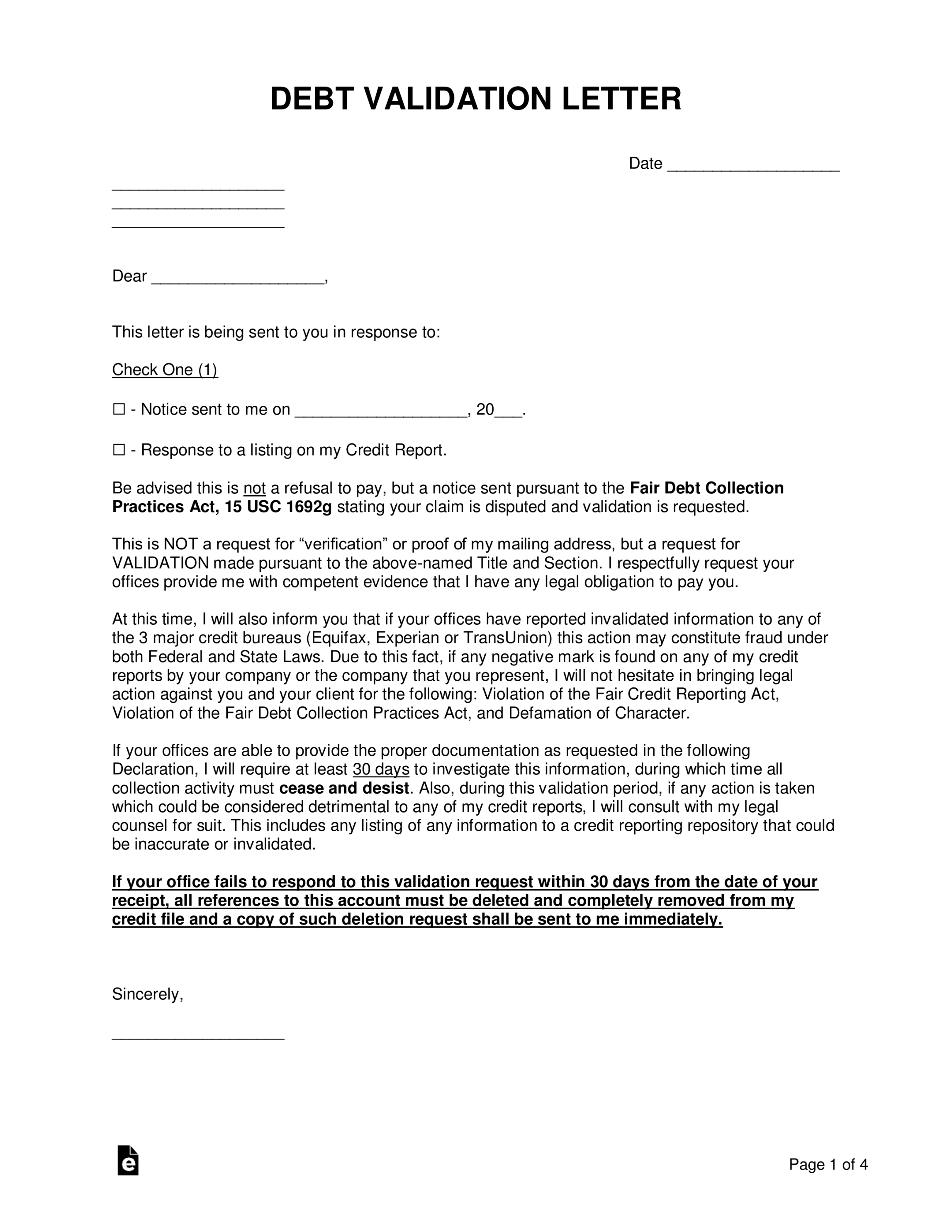

A debt validation letter is a formal document sent to a debt collector or creditor requesting verification of a debt. Under the Fair Debt Collection Practices Act (FDCPA), consumers have the right to dispute a debt within 30 days of receiving a debt collection notice. By sending a debt validation letter, you exercise your right to challenge the accuracy and validity of the debt.

Key Components of a Debt Validation Letter

While the specific content may vary depending on your individual circumstances, a well-crafted debt validation letter should include the following essential elements:

1. Your Contact Information

Your Full Name: Clearly state your full name at the top of the letter.

2. Creditor or Debt Collector Information

Creditor or Debt Collector Name: Identify the specific creditor or debt collector you are addressing.

3. Debt Details

Debt Account Number: If known, include the debt account number to reference the specific debt.

4. Validation Request

Clear and Concise Statement: Directly request that the creditor or debt collector validate the debt.

5. Communication Preferences

Preferred Method of Communication: Indicate your preferred method of communication, such as email or phone.

6. Consequences of Non-Validation

Sample Debt Validation Letter

[Your Name]

[Your Mailing Address]

[City, State, ZIP Code]

[Your Phone Number]

[Your Email Address]

[Date]

[Creditor or Debt Collector Name]

[Creditor or Debt Collector Address]

Dear [Creditor or Debt Collector],

I am writing to dispute a debt listed on my credit Report. The debt is identified as [debt account number] and was originally issued by [original creditor].

I am requesting that you validate this debt in accordance with the Fair Debt Collection Practices Act (FDCPA). To validate the debt, please provide me with the following information:

A copy of the original contract or agreement related to the debt.

I prefer to receive your response by [preferred method of communication] within [timeframe for response].

If you fail to validate this debt within the specified timeframe, I may take further legal action.

Thank you for your prompt attention to this matter.

Sincerely,

[Your Name]

Additional Considerations

Certified Mail: Consider sending your debt validation letter via certified mail with a return receipt requested to ensure delivery and obtain proof of mailing.

Conclusion

By sending a well-crafted debt validation letter, you can protect your rights as a consumer and potentially challenge the validity of a disputed debt. Understanding the key components and following the guidelines outlined in this guide will help you effectively exercise your rights under the Fair Debt Collection Practices Act.